Like residential mortgages, buy-to-let mortgages come at different rates and terms, so finding the best mortgage deal is still crucial. Read this guide to get acquainted with the rules, before you take the plunge, and use our buy to let mortgage calculator below. And consult our guide to mortgages for first-time buyers for even more info.. Our buy-to-let mortgages could help you make a success of your investment, whether you’re a first-time buyer or building up your property investment portfolio.. What’s the criteria for a buy to let mortgage? You’ll need to be 21 years or older to apply for a buy-to-let mortgage. If you’re considering a joint application, other.

Buytolet mortgage calculator Mortgage advice Rest Less

Buytolet mortgage rates continue to fall Maxine Lester Lettings, St Ives

Buy To Let Magee Mortgage Solutions Mortgages Belfast

Buytolet mortgage for first time buyers Online mortgages the easy way Molo Finance

How To Get A BuyToLet Mortgage YouTube

First Time Buyers, Find a mortgage, Purchases, Remortgages, Help to Buy, Buy to Let, Insurance

About Buy To Let Mortgages Mortgage Matters Direct

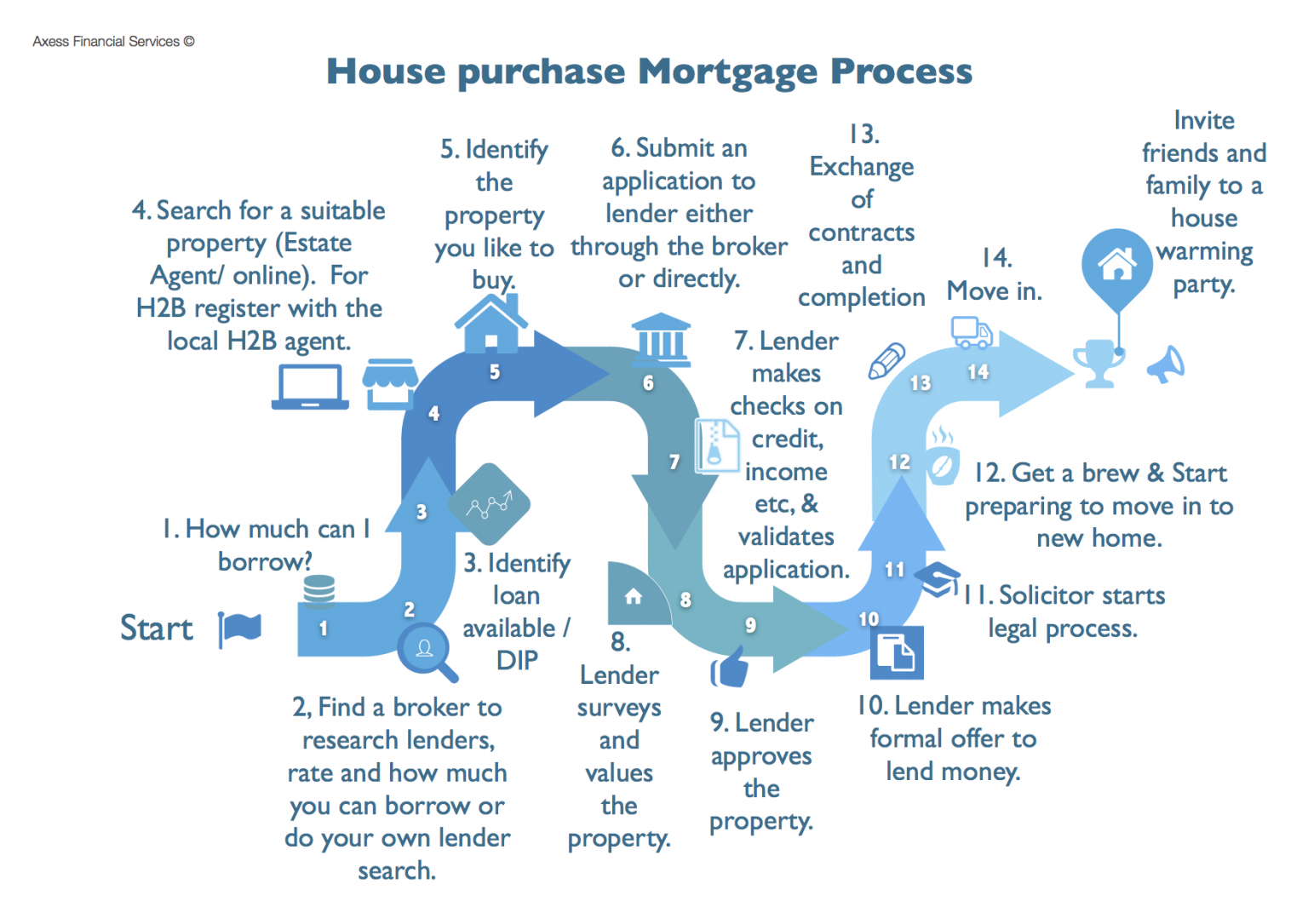

First Time Buyer Axess Financial Services

Buy to Let Mortgage Advice Top Mortgage Solutions

The best buy to let mortgages in London How to get buy to let Mortgages

Buy to Let Mortgage Tips and Advice Thompsons Lettings

Buy to Let Mortgage Help Mortgage Buddy

The best and cheapest buytolet limited company mortgage rates

Firsttime buyers on the rise as buytolet mortgage market falls Real Estate Sales and

Buy To Let Mortgage UK Explained Q&A (Time stamped) YouTube

Buy to Let Mortgage Index Q1 2019 by MFB Mortgage Finance Brokers Issuu

Buy to Let Mortgages Q&A with Jacqui Knapp from The Mortgage Corner

Review our latest buytolet mortgage and remortgage options

Buy to Let Advisors Mortgage Advice Buxton Mortgage Co

Can I get a buy to let mortgage as a firsttime buyer?

There was a time when buy-to-let investment was very popular, with many people remortgaging their main residence to finance the purchase of a buy-to-let property. As we recovered from the financial crisis and property values were on the rise, together with the leverage obtained by way of a mortgage, buy-to-let investments were booming.. Most buy-to-let lenders require landlords to have a deposit of between 15-25% of the property’s value to get a mortgage. As a first-time buy-to-let buyer. However, you will likely have to pay significantly more. This is where things become complicated. To illustrate, first-time residential buyers can often access mortgages with a 95% loan-to.