You may be able to claim leaving the UK tax back if any of the following apply: Your tax code is or was incorrect. You did not use all your tax free allowance during the tax year in which you left the UK. You have not reclaimed all the expenses for which you are eligible. These may include professional fees, the cost of tools and equipment for.. Calculate your UK tax back today. The UK tax back calculator is free and can help establish your potential tax rebate figure. The calculator can be used by both overseas workers and UK expats. The calculator gives you an estimate of what you might be owed from your pay and tax figures.

HMRC launches new online Inheritance Tax Tool Tax Banana

Bonus Calculator After Tax Uk

HMRC rules that Eamonn Holmes owes unpaid tax Tax Banana

5 Amazing Things You Need To Know About R&D Tax Credits Tax Banana

How does the new 202021 Scottish Budget affect you? Tax Banana

What will Capital Gains Tax changes mean to you? Tax Banana

UK helping to build better tax systems in developing countries Tax Banana

Claim UK Tax refund online UK Tax Back UK Tax Returns for Expats

What is a ‘reasonable excuse’ for missing the self assessment deadline? Tax Banana

Do I pay UK tax on cryptocurrency? Tax Banana

Do I pay tax or Capital Gains Tax on my cryptocurrency investments? Tax Banana

Leaving UK Tax Back Guide Taxback

New tax break for employers hiring veterans Tax Banana

HMRC don’t keep track of Lifetime Allowance pensions Tax Banana

Tips for listing the reasons you left your prior jobs on an employment application, including

Do tax rebates get paid automatically? Tax Banana

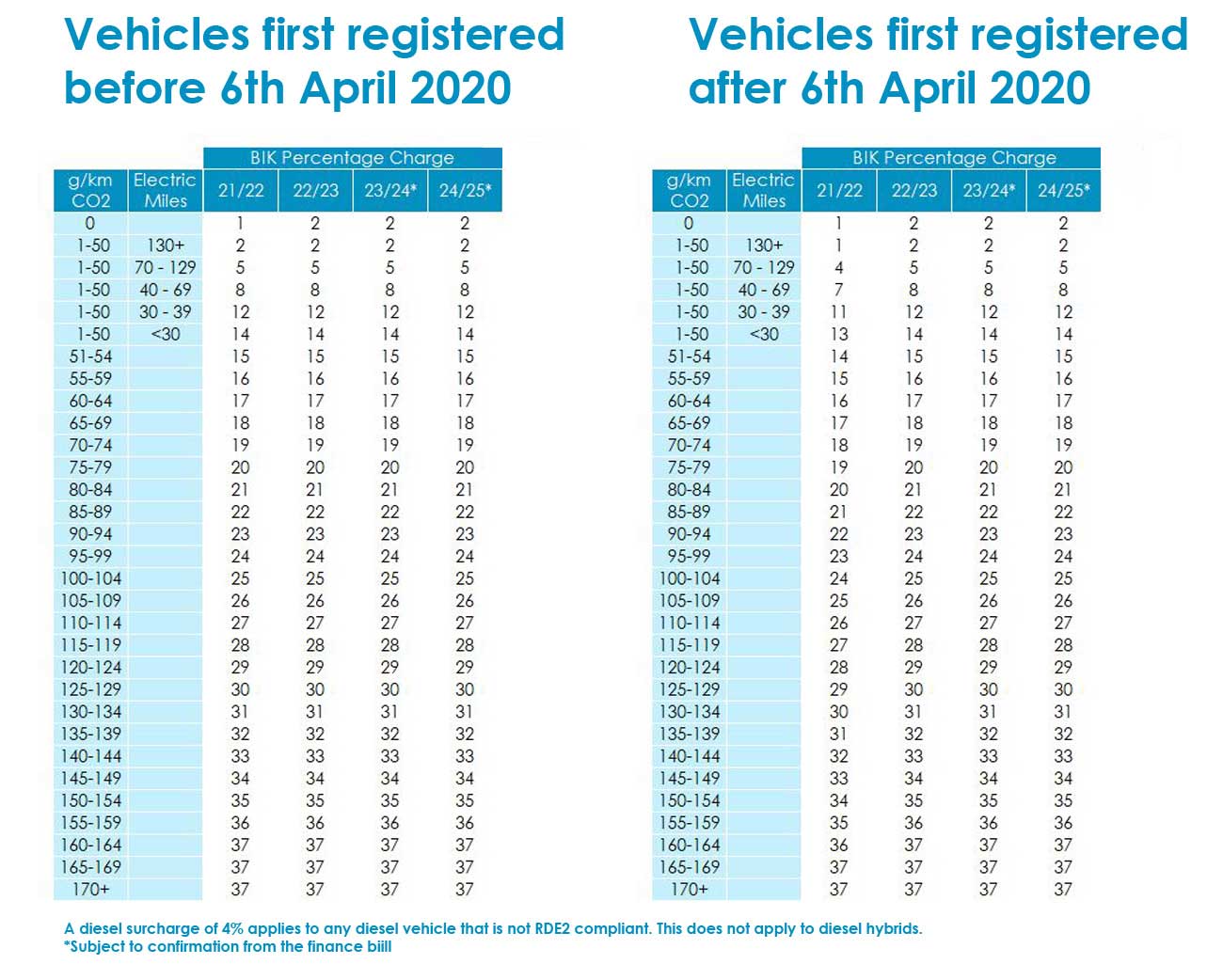

BIK Rates and Calculating your Company Car Tax News Wessex Fleet

Are you paying too much tax on your pension? Tax Banana

Understand your Tax Responsibilities when Leaving the UK

Are you going to be late with your self assessment tax return? You’re definitely not the only

You can claim online or use form P85 to tell HMRC that you’ve left or are leaving the UK and want to claim back tax from your UK employment. You can claim if you: lived and worked in the UK.. Tax Refund Check – Estimate | UK Tax Calculators. Below is our estimate for a possible tax refund you may be entitled to. This is based on the details you provided and takes into account various reliefs, allowances and checks the tax deducted on your incomes over the last four tax years.