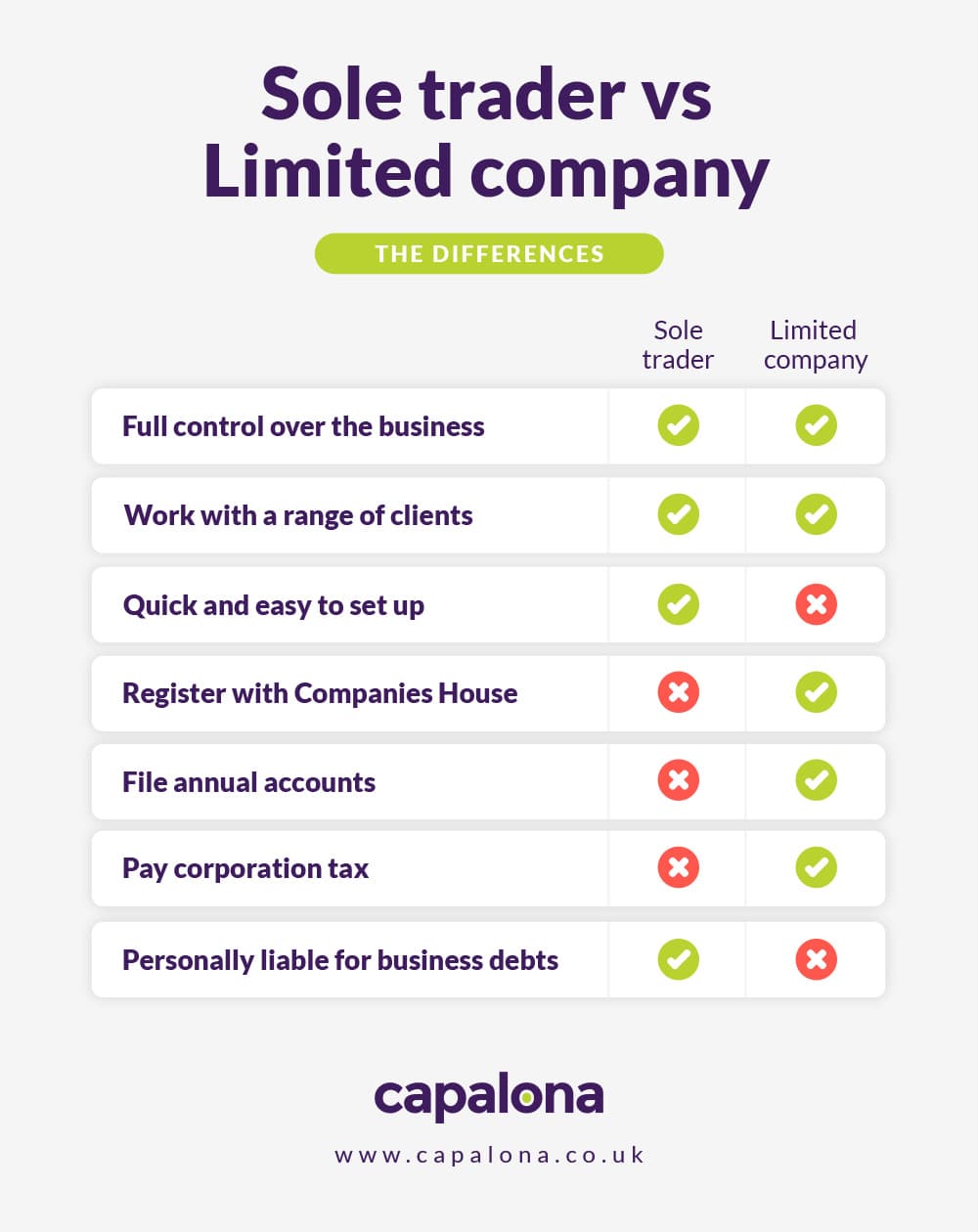

4.1 Advantages of Sole Trader. Being a sole trader comes with its own benefits: Simplicity: Setting up and managing a sole trader business is relatively straightforward and requires fewer formalities. Lower Costs: Sole traders often have lower setup and administrative costs compared to limited companies. Full Control: As a sole trader, you have.. Sole trader vs limited company: let’s talk tax. We’re not trying to poop the party, but we are your friendly neighbourhood tax know-it-alls, so we’ll bring tax into it every time. So with that being said, let’s talk about the different tax implications and how they differ when you’re a sole trader vs a limited company.

SOLE TRADER Text on Sticker on the Chart ,with Calculator and Magnifier Stock Photo Image of

Sole Trader vs. Limited Company Australia Pros and Cons YouTube

Ltd Company vs Sole Trader What’s the Difference? Evenstone

Sole Trader vs. Limited Company what’s in it for me? Brighton Chamber

What is a Sole Trader? Capalona

Private Limited Company vs. Sole Proprietorship & Partnerships Lendingpot

Is Registering In Form Of A Private Company Better Than L.L.P. And O.P.C. For Startups Inventiva

Starting a Business Sole Trader vs Company

Legal Requirements When Setting Up Your Business Marketing Favour

Sole Proprietorship VS Between two Business Structure

Limited company vs. sole trader what’s the difference and how do I register? Tamar

Sole Trader vs Limited Company Calculator

Sole Trader vs LTD Companies a Comparison Tax differences

Sole trader vs limited company A complete guide Finmo

Pros and Cons of Limited Company vs Sole Trader Q Accountants

Sole Trader or Limited Company?

(1).png)

Private Limited Company vs. Sole Proprietorship & Partnerships Lendingpot

Sole trader vs limited company All information

Sole Trader Tax Calculator 2023/24 Bytestart

difference between sole proprietorship partnership and company in table Dorothy Davies

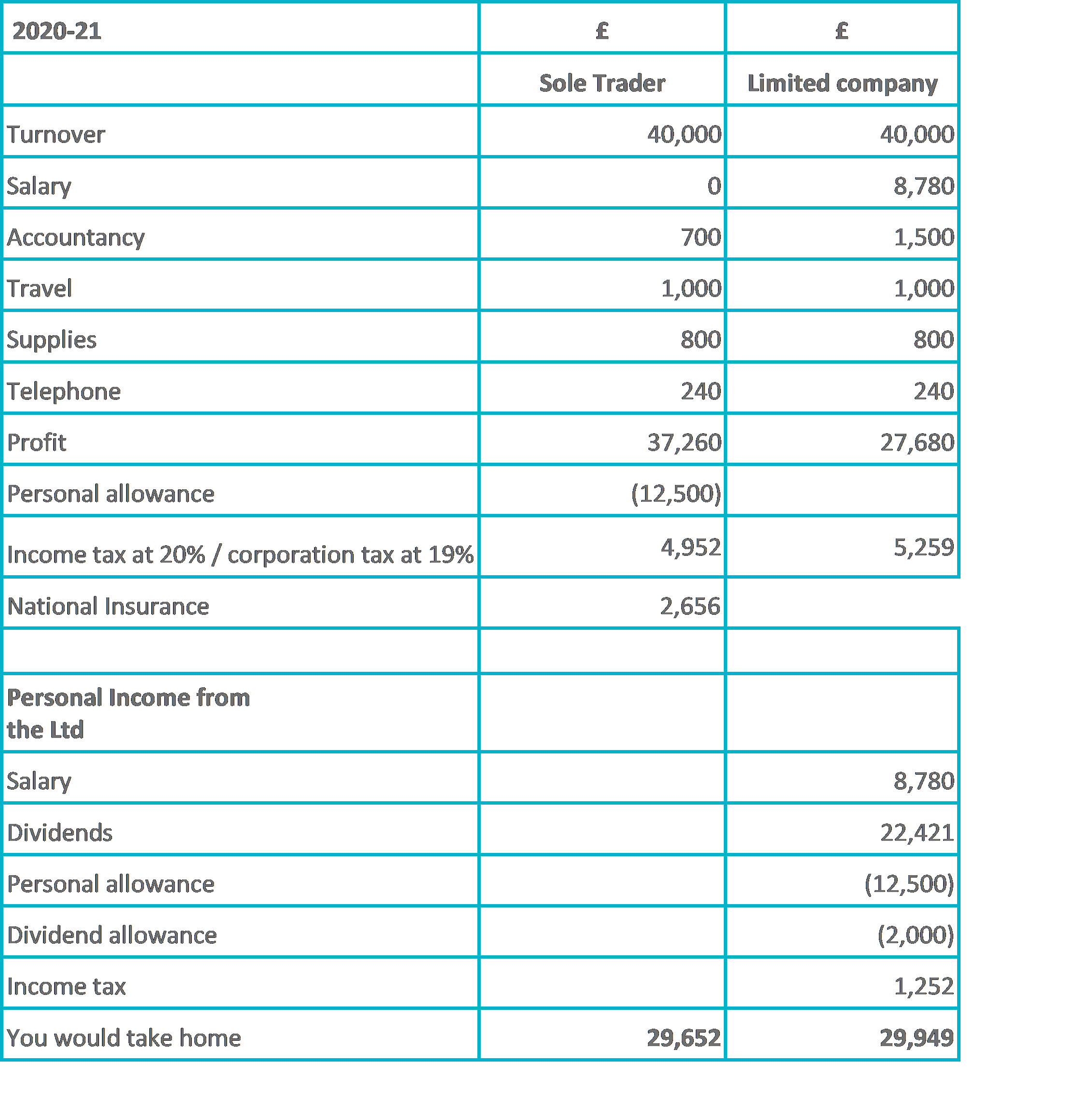

This sole trader versus limited company tax calculator enables you to estimate your take home pay, simply by inserting an estimate of your annual profit. Income tax and National Insurance calculators. Income tax calculators can be used to calculate your own income tax if you are an employee of your own company, and other employees’ income tax.. How to use the sole trader vs limited company tax calculator? This corporation tax calculator can evaluate your take-home income if you’re a sole trader or a limited company. Enter your annual revenue, excluding VAT and other expenses. Under both instances, the calculator will evaluate your expected take-home income.