The MSCB for 2023-24 is $62,270 per quarter ($249,080 per year), which equals a maximum SG contribution by your employer of $6,849.70 per quarter ($62,270 x 11%). The MSCB is a quarterly income figure, so it aligns with the requirement for your employer to make SG contributions into your super account on a quarterly basis.. Prior to 1 July 2023, your total super balance needed to be below $1.48 million for you to be able to contribute the full three years of annual caps ($330,000) under the bring-forward rule. On 1 July 2023, this threshold increased to $1.68 million. If your total super balance is above this limit, your ability to bring forward future year caps.

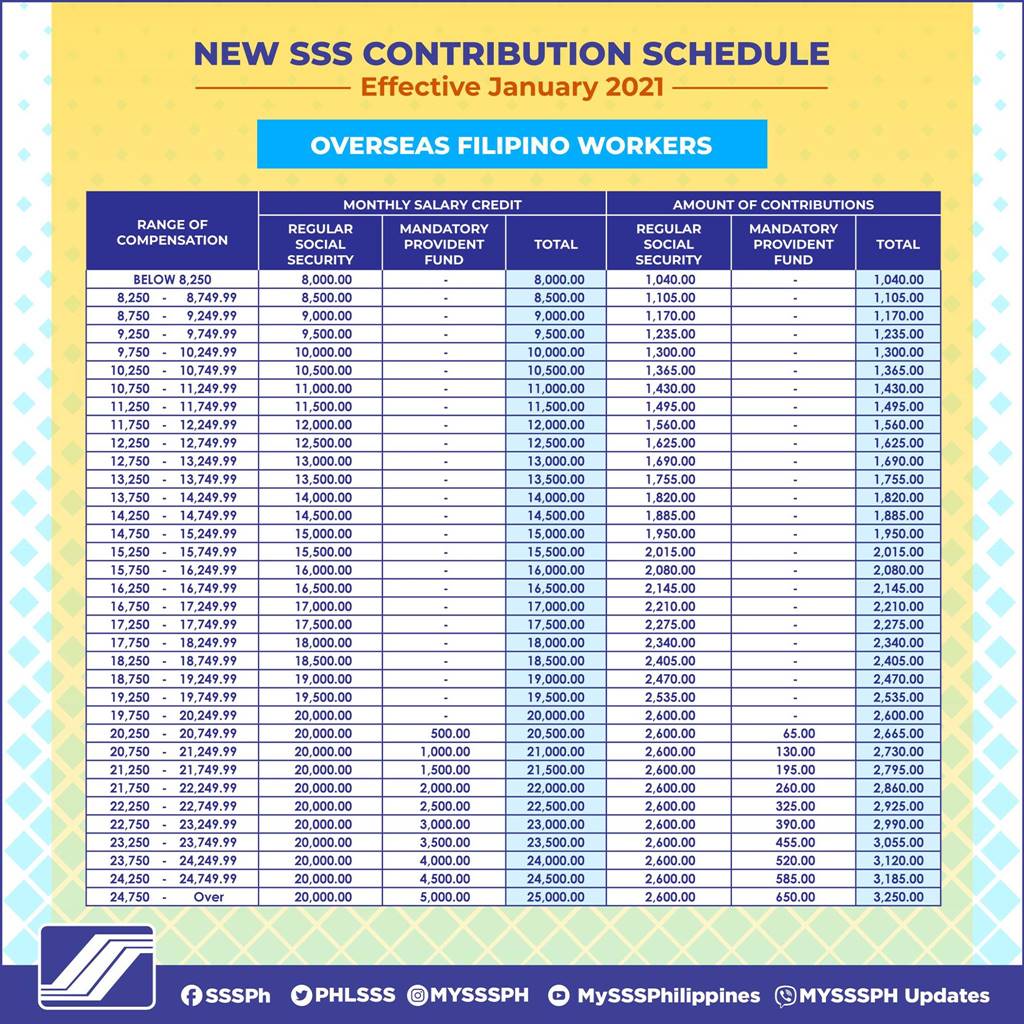

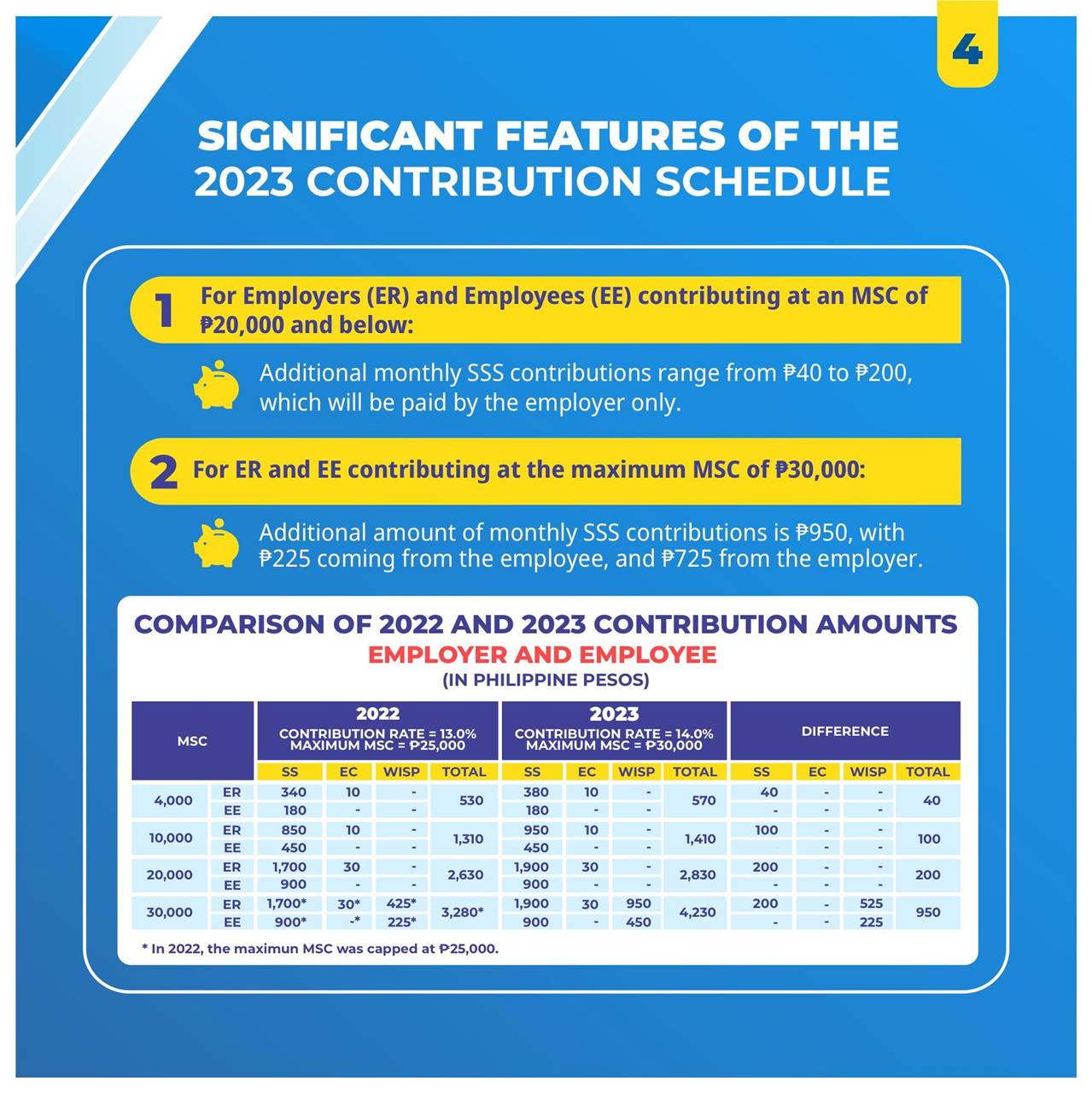

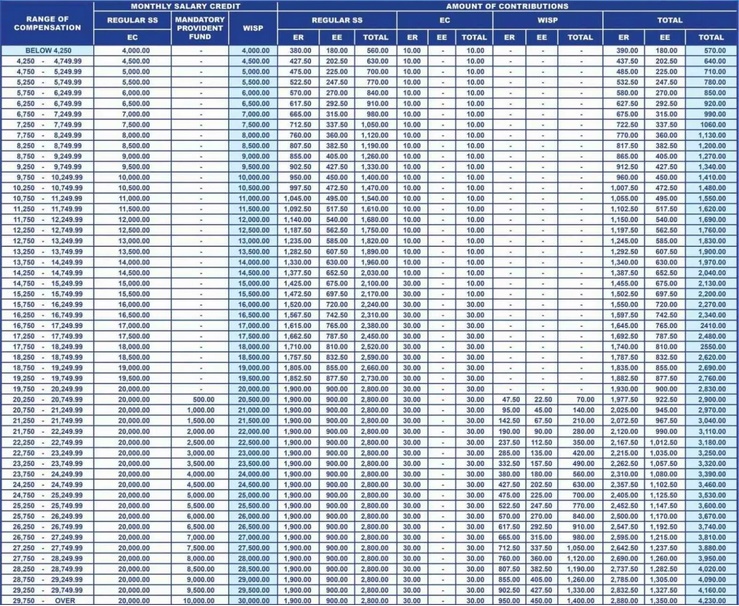

2023 Sss Contribution Table And Schedule Of Payment T vrogue.co

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

New sss contribution table 2023 Artofit

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog

401k 2022 contribution limit chart Choosing Your Gold IRA

Superannuation Pre 30 June Considerations and Opportunities Cooper Partners

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits

401(k) Contribution Limits in 2023 Meld Financial

Annual Retirement Plan Contribution Limits For 2023 Social(K)

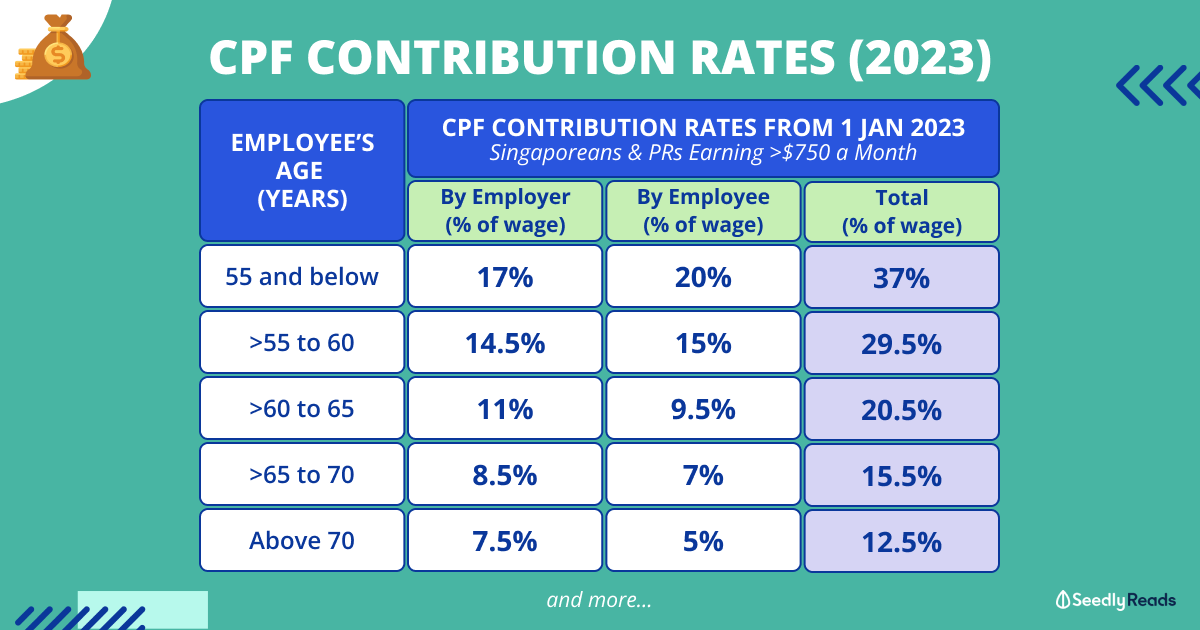

CPF Contributions Got Limit? What Singaporeans Need to Know About Yearly CPF Contribution Caps

CPF Contribution Rates 2023 All You Need To Know About the Latest Rates & Contribution Caps

2023 SSS Contribution Table and Schedule of Payment The Pinoy OFW

Rate SSS Contribution 2023 Here’s Guide on How Much You Must Pay as Monthly Contribution

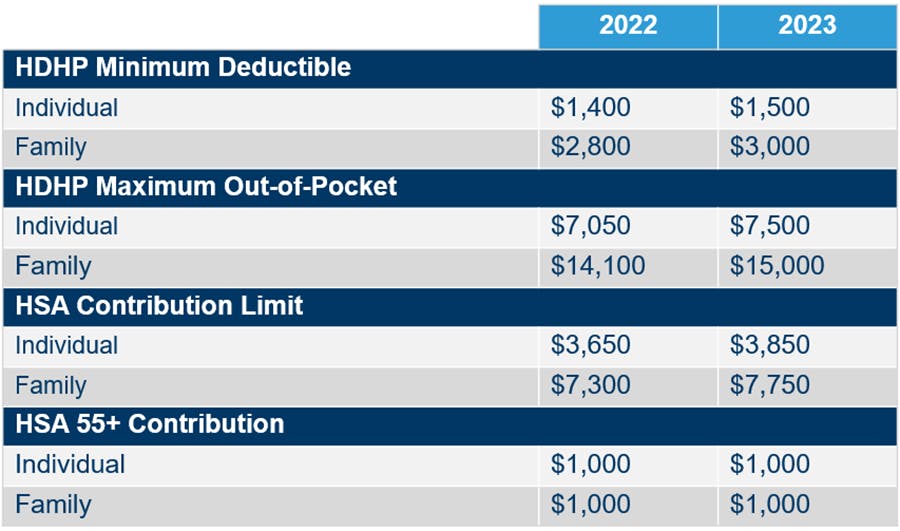

Significant HSA Contribution Limit Increase for 2023

Latest Philhealth Contribution Table 2023 Life Guide PH

SSS Contribution Table 2023 Here’s Guide on Members Monthly Contributions Based on

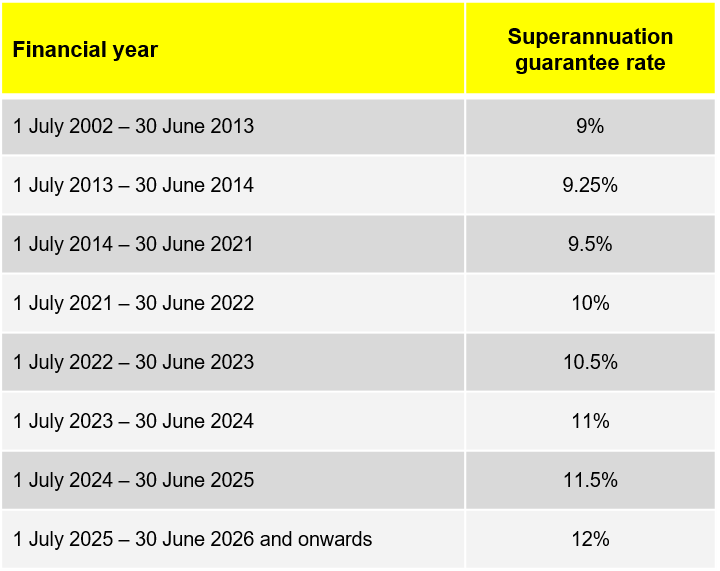

Increase to employer super contribution rate Walsh Accountants

What you need to know about the 3 Million Dollar Super Contribution Cap 2023 Precision Wealth

New sss contribution table 2023 Artofit

Maximum Defined Contribution 2024 Sandy Cornelia

employer contributions (including contributions made under a salary sacrifice arrangement). October – December 2023. 7.15%. 0.019589041095890%. July – September 2023. 6.90%. 0.018904109589041%.. you could contribute up to $1 million of non-concessional contributions to your super fund. This limit was referred to as the transitional.. The superannuation guarantee is the official term for compulsory super contributions made by employers on behalf of their employees. The superannuation guarantee amount for 2023-24 is 11% of an employee’s ordinary time wages or salary. This rate is scheduled to increase progressively to 12% by July 2025, as outlined in the table below. Period.